In this high-tech era of computers and machines, the purchasing power of people is mostly based on credit. Nowadays, credit cards are almost indispensable in almost any business transaction. For one, nobody can purchase anything online without a credit card.

In this high-tech era of computers and machines, the purchasing power of people is mostly based on credit. Nowadays, credit cards are almost indispensable in almost any business transaction. For one, nobody can purchase anything online without a credit card.People who have a poor credit history though, will have a hard time getting or renewing their credit cards. This is where prepaid credit becomes useful.

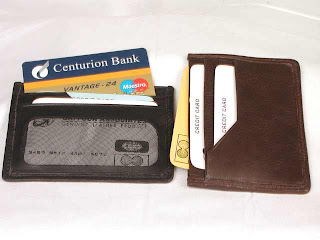

There are lenders that offer prepaid MasterCards and/or prepaid Visa Cards. Both these cards can be used like a regular credit card. It is even hard to distinguish which card is prepaid or not, by simply looking at it or even using it.

This is basically how prepaid credit cards work. When an account is opened, the card should be “pre-loaded” with cash up-front. This is like paying for a pre-paid calling card. Prepaid MasterCards or Visas can be used anywhere as long as these cards are accepted.

The prepaid credit card advantage:

1. Prepaid credit card can be easily obtained. It can be purchased online or in local retail stores. It does not require any credit check or proof of income.

The only thing to do is to fill out an application, pay a small fee for setting-up the account and load the card with cash. The amount of cash loaded will be the “credit limit”

2. No interest charges.

When a prepaid MasterCard or prepaid Visa is used, there is no interest charge unlike the regular credit card. The reason for this is that the money used is the owner’s actual money therefore no interest is needed.

3. Prepaid credit cards are free from financial or credit problems.

4. Prepaid cards can be used almost anywhere. Prepaid MasterCards and Visa cards are almost accepted anywhere in the world.

Disadvantages of Prepaid Credit Cards:

1. Usually a set-up fee of 5 to 50 dollars is needed when an account is opened. Then another fee of $5 or more is paid every time more money is loaded onto the card.

Regular credit cards usually do not charge a set-up fee or annual fees.

2. Cash up front is needed before any purchase could be made with the prepaid card. This could be an advantage since compulsive spending can be avoided.

3. There are some prepaid credit cards that cannot be used to pay regular payments such as monthly electric consumption or online services.

The Conclusion:

The prepaid credit card is a definite help for people who have past credit problems. It is just a matter of choosing the right prepaid credit card that suits ones’ needs.